Author Rusty Rosman invites us into her family holiday traditions

Rusty shows us how she makes—and transports—”Nema’s Traveling Matzah Ball Soup”

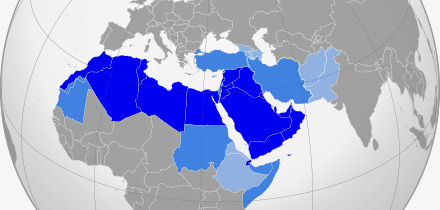

OUR AUTHORS and READERS are wishing our Jewish colleagues and neighbors well as they prepare for this traditional festival with family and friends—starting on the night of April 22. Right now, Jewish families around the world already are preparing for their Passover seders. These special meals are a lot of work!

Rusty is a grandmother who travels with her matzoh ball soup to various family homes as Passover begins—so she has developed a way to make that beloved soup quite portable. If you enjoy this story about her soup, please share it with friends across social media. All of us want to warmly celebrate with our Jewish friends at a time when antisemitism has risen to the highest levels the FBI has seen in their tracking of hate crimes.

And, stay tuned, because of course we will have more Passover coverage in our next weekly issue of ReadTheSpirit.com magazine on Monday, April 22—which is the first night families will be gathering for seders.

.

And why is interfaith support so important right now?

George A. Mason explains why we need ‘dependable allies in the struggle for freedom, justice, and equity’

IN DALLAS, TEXAS, a century-old coalition of Jewish women honors the Rev. Dr. George A. Mason as a Pioneering Partner in interfaith work—and Mason tells the group why this kind of cooperative work is so urgent right now. You can read his stirring acceptance speech in this column and see photographs from the event. It’s a quotable talk by a prophetic preacher, so you’ll likely want to share this with friends as well.

.

Holidays & Festivals

An introduction to Passover

OUR HOLIDAYS & FESTIVALS columnist Stephanie Fenton literally wrote the book for non-Jews about Jewish holidays—meaning that she wrote the section in the MSU Bias Busters’ book about American Jews and their holiday traditions. In this week’s column, she summarizes the basic traditions of Passover—and she includes a link to that valuable MSU book as well. That MSU Bias Busters series was launched to counter bigotry with helpful information about religious, cultural and racial minorities in the U.S. Want to perform a mitzvah yourself this month? Share with friends a copy of this MSU book—or others in what is now a 21-volume Bias Busters series.

.

Ridvan

The most holy Baha’i festival worldwide is the 12-day period known as Ridvan—which starts on Saturday April 20.

Vaisakhi (or Baisahki)

Colorful processions in Indian communities mark the arrival of this month with a wide range of spiritual customs from prayers for crops to pilgrimages. Columnist Stephanie Fenton describes the diversity of cultural connections with this auspicious month.

Hanuma Jayanti

Indian communities will soon be honoring one of the most colorful figures in Hindu heritage—the half-human and half-monkey figure Hanuman.

.

WANT TO SEE ALL OF THE UPCOMING HOLIDAYS & FESTIVALS?—It’s easy to find our annual calendar of global observances. Just remember the web address: InterfaithHolidays.com

...

And more news this week—

Mindy Corporon—

The public TV documentary about her courageous call for transformation is now streaming online

‘HEALING HATE: Turning Pain into Power’ That’s the name of the new public TV documentary about two courageous women who have transformed the trauma of losing loved ones through hate crimes into campaigns for community healing. Now, thanks to the staff at Kansas City public TV, the entire half-hour film is available to stream online. We’ve got that YouTube streaming link for you right here in our feature story about Mindy that we have updated since last week.

.

.

Suzy Farbman—

Learning from Elie Wiesel and Mitch Albom

IN HER GodSigns column this week, Suzy Farbman writes about hard-won wisdom about resiliency that she sees in the writings of both Elie Wiesel and Mitch Albom.

.

.

Laura Elizabeth teaches the art of cozy mysteries

WE ASKED cozy mystery author Laura Elizabeth to write this column about her recent experience teaching tips and techniques for crafting a cozy mystery, one of the most popular genres in American publishing.

.

.

And speaking of academia—

And speaking of academia—

Another major scholar is changing his mind

MAJOR NEWS THIS WEEK among religious leaders who are encouraging acceptance of LGBTQ+ individuals and families is the declaration of evangelical Christian scholar Dr. Richard Hays that he has changed his mind on this issue. Hays has announced that he will publish a book this autumn along with his son, who also is a noted Bible scholar, explaining why churches should welcome LGBTQ+ folks. This Religion News Service story about this milestone describes Hays as “a darling among conservative evangelical Christians who opposed LGBTQ acceptance in their churches and the broader culture and frequently cited Hays’ work in debates.”

The RNS report also cites the influence of Dr. David Gushee’s landmark book, Changing Our Mind. Since Hays book won’t be out until September, why not get a copy of Dr. Gushee’s book right now to learn more about this movement among our nation’s leading religious academics?

.

.

Click on this image to learn more about the April 2024 issue of Ed McNulty’s Visual Parables Journal, including films such as One Life, Irena’s Vow, Cabrini and Asphalt City.

Faith & Film

ED McNULTY, for decades, has published reviews, magazine articles and books exploring connections between faith and film. Most of his work is freely published. Ed supports his work by selling the Visual Parables Journal, a monthly magazine packed with film reviews and discussion guides. This resource is used nationwide by individuals who love the movies and by educators, clergy and small-group leaders.

Here are some of Ed’s most recent free reviews and columns:

- ASPHALT CITY—Ed writes, “French-born director Jean-Stéphane Sauvaire has gifted us with the most harrowing parable about an ambulance medic since Martin Scorsese’ 1999 film Bringing Out the Dead.”

- WICKED LITTLE LETTERS—”The film becomes a whodunnit period piece and study of character and class, ending with a court drama that is fun to watch.”

- IMMACULATE—”Director Michael Mohel combines horror with religion in this tale of twisted religious fanaticism joined with male chauvinism.”

- DUNE, PART 2—Ed urges us to continue with this remarkable series. “The incredible production values are matched by the A-list actors.”

- IRENA’S VOW—“Director Louise Archambault drew on a script by Dan Gordon, based on his Broadway play focusing on the young Polish nurse Irena Gut Opdyke.”

- ONE LIFE—”Director James Hawes’s, film straddling two time periods, focuses upon a part of the Kindertransport during World War II and the man mainly responsible for its success.”

- CABRINI—This film “is probably the best defense of immigrants that you will see in this or any year.”

- BOB MARLEY: ONE LOVE—“Director Reinaldo Marcus Green’s film focuses upon a couple of years of the singer/composer’s life, with flashbacks to his teenage years.”

- ORDINARY ANGELS—Ed recommends this faith-based drama.

- PERFECT DAYS—Ed urges us not to miss Wim Wender’s Oscar-nominated film.

- THE TASTE OF THINGS—Ed writes, “You do not have to be a Foodie to enjoy director Tran Anh Hung’s fabulous film about a French epicure and his female chef.”

- DRIVING MADELEINE—Ed writes, “For me it is a delightful visual parable on the rewards of kindness.“

- THE ZONE OF INTEREST—Ed gives 5 stars to this unusual and haunting Holocaust drama.

.

.

.

.

.

.