Michigan’s JCRC-AJC model seder brings nations together

‘Confronting all forms of hate is everyone’s responsibility.’

COVER STORY—As Passover begins with the first seder this evening, Monday April 22, 2024, author and peace activist Howard Brown brings us the story of a long-time commitment of the Jewish community in southeast Michigan to host “diplomatic model seders.” This year, despite rising antisemitism around the world, that tradition continued and more than 100 people representing many nations attended and prayed together.

A Prayer for the Seder: ‘Let all who are hungry come and eat’

YACHATZ: THE BREAKING—Author Rabbi Roy Furman uses the traditional invocation, ‘Let all who are hungry come and eat,’ in this prayer-poem for Yachatz, the ritual breaking of matzah in the seder.

.

And Other Passover Stories—

‘Nema’s Traveling Matzah Ball Soup’

If you enjoy this story about her soup, please share it with friends across social media. All of us want to warmly celebrate with our Jewish friends at a time when antisemitism has risen to the highest levels the FBI has seen in their tracking of hate crimes..

An introduction to Passover

OUR HOLIDAYS & FESTIVALS columnist Stephanie Fenton literally wrote the book for non-Jews about Jewish holidays—meaning that she wrote the section in the MSU Bias Busters’ book about American Jews and their holiday traditions. In this week’s column, she summarizes the basic traditions of Passover—and she includes a link to that valuable MSU book as well. That MSU Bias Busters series was launched to counter bigotry with helpful information about religious, cultural and racial minorities in the U.S. Want to perform a mitzvah yourself this month? Share with friends a copy of this MSU book—or others in what is now a 21-volume Bias Busters series.

.

Ridvan

The most holy Baha’i festival worldwide is the 12-day period known as Ridvan—which started on Saturday April 20.

Hanuma Jayanti

Indian communities will soon be honoring one of the most colorful figures in Hindu heritage—the half-human and half-monkey figure Hanuman.

.

WANT TO SEE ALL OF THE UPCOMING HOLIDAYS & FESTIVALS?—It’s easy to find our annual calendar of global observances. Just remember the web address: InterfaithHolidays.com

...

And more news this week—

Mindy Corporon engaging in a national conversation about confronting hatred

As a publishing house, we often talk about our authors “engaging in a national conversation” as one of the primary reasons to do all the hard work of writing, editing and publishing a book. Quite simply: We want to make our world a better place with the creative and compassionate ideas we are sharing.

.

..

Click on this image to learn more about the April 2024 issue of Ed McNulty’s Visual Parables Journal, including films such as One Life, Irena’s Vow, Cabrini and Asphalt City.

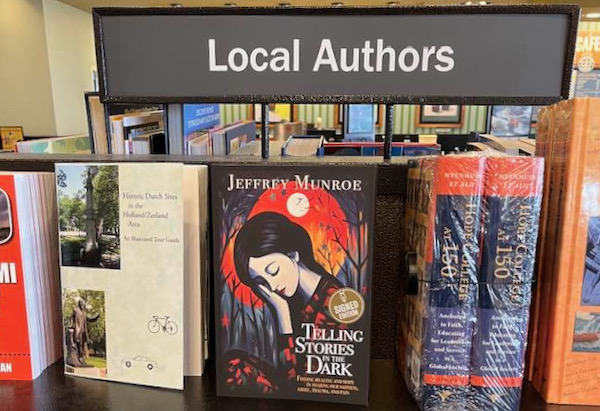

Faith & Film

ED McNULTY, for decades, has published reviews, magazine articles and books exploring connections between faith and film. Most of his work is freely published. Ed supports his work by selling the Visual Parables Journal, a monthly magazine packed with film reviews and discussion guides. This resource is used nationwide by individuals who love the movies and by educators, clergy and small-group leaders.

Here are some of Ed’s most recent free reviews and columns:

- CIVIL WAR—Ed writes, “Many angry citizens, who are upset over seemingly intractable political disputes, have talked about civil war breaking out in our nation—and would do well to watch writer/director Alex Garland’s film.”

- IN THE LAND OF SAINTS AND SINNERS—”Liam Neeson’s latest foray into violence-laden action films is a little more nuanced than his usual fare.”

- ASPHALT CITY—”French-born director Jean-Stéphane Sauvaire has gifted us with the most harrowing parable about an ambulance medic since Martin Scorsese’ 1999 film Bringing Out the Dead.”

- WICKED LITTLE LETTERS—”The film becomes a whodunnit period piece and study of character and class, ending with a court drama that is fun to watch.”

- IMMACULATE—”Director Michael Mohel combines horror with religion in this tale of twisted religious fanaticism joined with male chauvinism.”

- DUNE, PART 2—Ed urges us to continue with this remarkable series. “The incredible production values are matched by the A-list actors.”

- IRENA’S VOW—“Director Louise Archambault drew on a script by Dan Gordon, based on his Broadway play focusing on the young Polish nurse Irena Gut Opdyke.”

- ONE LIFE—”Director James Hawes’s, film straddling two time periods, focuses upon a part of the Kindertransport during World War II and the man mainly responsible for its success.”

- CABRINI—This film “is probably the best defense of immigrants that you will see in this or any year.”

- BOB MARLEY: ONE LOVE—“Director Reinaldo Marcus Green’s film focuses upon a couple of years of the singer/composer’s life, with flashbacks to his teenage years.”

.

.

.

.

.

.

.

.

.