Bishops, clergy, lay leaders call for welcoming LGBTQ+ neighbors

Bishops, clergy, lay leaders call for welcoming LGBTQ+ neighbors

Authors, scholars, journalists are ready to help

OUR COVER STORY THIS WEEK starts with the historic news that America’s third largest Christian denomination—the United Methodist Church—has reversed more than half a century of LGBTQ+ exclusion. And now—the challenge voiced by United Methodist bishops, pastors and lay leaders nationwide is: “Welcoming all people into the embrace of God.”

And, if you are inspired, take a moment to share this cover story with friends this week via social media and email. Together, we can help to expand the compassionate circle in communities nationwide.

.

.

And also from our writers—

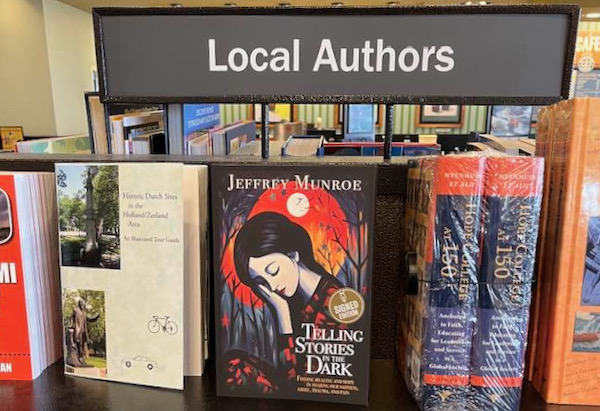

Clicking on this cover image will take you to the Amazon page for Jeffrey Munroe’s book, “Telling Stories in the Dark,” which features Roger Nelson’s story.

Jeffrey Munroe:

A Story of a Church Still Struggling

WHILE OUR PUBLISHING HOUSE is celebrating the United Methodist journey toward inclusion, this week, some Christian denominations remain deeply divided over gender and sexual orientation. Our author Jeffrey Munroe—who heads up the historic Reformed Journal online magazine—has just published such a story by Roger Nelson. Jeff explains, “Roger’s remarkable story of resilience after witnessing his father’s murder appears in my book. For more than two decades, Roger has been a pastor who has compassionately led his congregation through divisions around human sexuality. Now, Roger writes for our Reformed Journal about facing a threat of expulsion from his denomination.”

.

.

George A. Mason:

‘Spend it all now!’

ONE OF THE NATION’S LEADING PREACHERS, George A. Mason wrote this brief column to encourage his fellow writers—urging all of us who write to use our best ideas now. George’s memorable little column encouraging our ongoing flow of ideas, as writers, appears in our Front Edge Publishing blog, this week.

.

.

Holidays & Festivals

Are you ready for Mother’s Day?

HOLIDAYS & FESTIVALS columnist Stephanie Fenton reports in her column, this week, that Mother’s Day continues to draw the largest church attendance of the year after Christmas and Easter.

And, Ascension Day is this week, too

STEPHANIE FENTON has this holiday story, as well. Did you know that this is one of the oldest Christian traditions? Each year, the Feast of the Ascension takes place on the 40th day after Easter.

.

WANT TO SEE ALL OF THE UPCOMING HOLIDAYS & FESTIVALS?—It’s easy to find our annual calendar of global observances. Just remember the web address: InterfaithHolidays.com

…

.

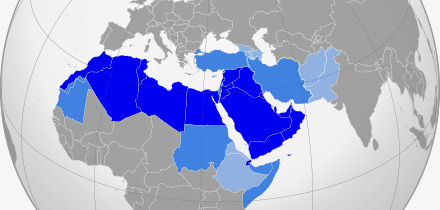

In honor of Yom Hashoah, Holocaust Remembrance Day (May 5-6 in 2024), our film critic Ed McNulty reaches back to 1970 and suggests that people watch “The Only Way,” about how Danes risked their lives to help save thousands of Jews during World War II.

Faith & Film

ED McNULTY, for decades, has published reviews, magazine articles and books exploring connections between faith and film. Most of his work is freely published. Ed supports his work by selling the Visual Parables Journal, a monthly magazine packed with film reviews and discussion guides. This resource is used nationwide by individuals who love the movies and by educators, clergy and small-group leaders.

Here are some of Ed’s most recent free reviews and columns:

- HARD MILES—Ed writes, “This film will leave you feeling hopeful that redemption can come to seemingly hopeless youth—and also will leave you with a sense of awe at the grandeur of Nature.”

- SASQUATCH SUNSET—”David & Nathan Zellner have chosen to build his film around an unusual group of a species that may exist only in our imaginations, a family of Sasquatches.”

- SUZUME—”Director/writer Makoto Shinkai and his team of animators provide a mythological interpretation for the hundreds of earthquake tremors Japan suffers each year.”

- WE GROWN NOW—”Writer/director Minhai Baig’s ‘must-see’ film is an elegiac story of an imaginative boy facing the end of a way of life. It makes me believe all the more that the best of films are being made by independent filmmakers.”

- PROBLEMISTA—”In this surrealistic film, writer-director Julio Torres provides an unusual twist to the story of an immigrant struggling mightily to stay in this country but is harrassed by a soulless immigration bureaucracy.”

- CIVIL WAR—Ed writes, “Many angry citizens, who are upset over seemingly intractable political disputes, have talked about civil war breaking out in our nation—and would do well to watch writer/director Alex Garland’s film.”

- DUNE, PART 2—Ed urges us to continue with this remarkable series. “The incredible production values are matched by the A-list actors.”

- IRENA’S VOW—“Director Louise Archambault drew on a script by Dan Gordon, based on his Broadway play focusing on the young Polish nurse Irena Gut Opdyke.”

- ONE LIFE—”Director James Hawes’s, film straddling two time periods, focuses upon a part of the Kindertransport during World War II and the man mainly responsible for its success.”

- CABRINI—This film “is probably the best defense of immigrants that you will see in this or any year.”.

.

.

.

.

.

.

.

.

.

.